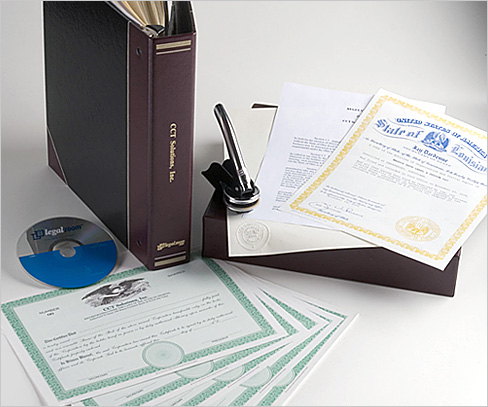

Corporate Maintenance & Compliance with Accountant in Vaughan

ADVANTAGES OF INCORPORATING in Vaughan

1. Limited Liability. Number one reason why most people incorporate their businesses in Vaughan! Creditors are only able to seize assets of the company to settle outstanding debts. Your personal assets are protected.

2. Status. Your customers will view your business as larger and more prestigious.

3. Capital. If additional capital is required, a corporation in Vaughan is more attractive to those who have money to invest.

4. Tax Savings. Although there is more record keeping required, there are significant tax advantages such as a lower tax rate for corporation in Vaughan ON.

5. Estate Planning Benefits. Since the corporation in Vaughan is a separate “person” under the law it does not expire when the shareholders die. Significant estate planning benefits may exist to help your family.

Incorporating your business in Vaughan is a high-quality, efficient and cost-effective way by Corporate Accountant in Vaughan! Also understanding the responsibility and liability of shareholder is very important before incorporate a company. Please call Karn, Accountant in Vaughan for more information at 905-794-8283.

Registered Charity by Tax Accountant in Vaughan

The importance of registered charity means according to CRA is where your hard earn dollar was spend by the charity. When donating more than five hundred dollars please ensure that you do not pay cash and you pay through a cheque, credit card, etc. because CRA needs proof of payment when you make claim in your taxes, by Tax Accountant in Vaughan.

Checklist

ENGAGE ONLY IN ALLOWABLE ACTIVITIES – A registered charity is allowed to carry out its charitable purposes both inside and outside Canada in only two ways: by carrying on its own charitable activities, and by gifting to qualified donees. A registered charity must maintain direction and control over its activities (whether carried out by the charity, or by an agent or contractor on its behalf) and must not engage in prohibited political activities or unrelated business activities. Be aware of tax incentive scemes for larger donation and get larger tax refund by Tax Accountant in Vaughan.

KEEP ADEQUATE BOOKS AND RECORDS – A registered charity must keep adequate books and records for the prescribed time period, in either English or French, at an address in Canada that is on file with the Canada Revenue Agency (CRA).

ISSUE COMPLETE AND ACCURATE DONATION RECEIPTS – A registered charity may only issue official receipts for donations that legally qualify as gifts. An official receipt must contain all the information specified in Regulation 3501 of the Income Tax Act. See sample receipts.

MEET ANNUAL SPENDING REQUIREMENT (DISBURSEMENT QUOTA) – A registered charity must spend the minimum amount calculated for its disbursement quota each year on its own charitable activities, or on gifts to qualified donees (for example, other registered charities).

FILE ANNUAL T3010 INFORMATION RETURN – A registered charity must file an annual T3010 information return (together with financial statements and required attachments) no later than six months after the end of the charity’s fiscal period by their Tax Accountant in Vaughan.

MAINTAIN THE CHARITY’S STATUS AS A LEGAL ENTITY – A registered charity that is constituted federally, provincially, or territorially must meet other specific requirements (in addition to the requirements of CRA) in order to maintain its status as a legal entity. This may include annual filing and/or annual fees. A registered charity should check with the relevant authorities to verify these additional requirements.

INFORM THE CHARITIES DIRECTORATE OF ANY CHANGES TO THE CHARITY’S MODE OF OPERATION OR LEGAL STRUCTURE – A registered charity should get confirmation from the Charities Directorate (the Directorate) before changing its stated objects and/or activities to make sure they qualify as charitable, tax Accountant in vaughan. A registered charity should inform the Directorate if it changes its name, telephone number, address, contact person or governing documents (constitution, letters patent, etc.) and must obtain prior approval from the Directorate before changing its fiscal period end by your tax accountant in vaughan.

For more information:

http://www.cra-arc.gc.ca

When couples hover between tax brackets: How to stay in the lower one by your accountant at brampton

Tax planning for your 2011 income tax year by Accountant at

Brampton. You can reduce your taxable income by claiming RRSP, child care expense, employment expense and other deductions by your accountant brampton. Our Canadian tax system has 4 steps; each time you jump to a new level, the taxes on each additional dollar earned increase. This tax rate on your last dollar earned is called your ‘marginal tax rate’ but your ‘effective tax rate’ is the average of them all. (For you trivia folks, the average tax rate paid by Canadians is 25%.) If you can reduce your taxable income to keep from moving up into that next bracket, then you can save on your overall tax bill. How can you lower your taxable income?

RRSP Contributions

An RRSP contribution is your go-to accessory for your tax savings needs accountant brampton. Every dollar you put into an RRSP is a dollar deducted from your taxable income. Don’t forget there is also the option of spousal contributions: If, for example, you contributed on your husband’s behalf, then you get the tax deductions (money back on your tax return), he gets the investment and the long-term growth, and he pays the taxes when he takes it out. You have 60 days after the year-end to contribute to an RRSP, so you can do a preliminary calculation (or your accountant at brampton can) to figure out the best way to contribute the dollars you can spare. There are also RRSP loans available, though these are generally not recommended unless you’re saving at the top marginal rate and you can pay the loan off fully with the money back on your tax return.

Your Investment Mix

If you have taxable income from investments, then you can lower your income by changing your asset mix from interest-bearing investments

to those that pay dividends or produce capital gains. This often means taking on more risk in your portfolio, which may not be suitable for your financial situation.

Employment Expenses

If either (or both) of you and your spouse is self-employed, please consult with an accountant at brampton. There are just too many taxable-income-lowering options to mention in this scenario. Other possibilities for lowering your taxable income. There are a few items that reduce taxable income that you don’t have a lot of control over, such as pension contributions, professional or union dues, and qualified moving expenses.

Tax Credits

Even if you can’t lower your taxable income, you should maximize tax credits that reduce the amount of tax you pay, and that at the end

of the day, give you the same result — fewer taxes paid by your accountant at brampton. For example, are you taking advantage of the equivalent-to-spouse credit? Did you know that the public transit credit is transferable to a spouse? And that the highest-value tax credit of all is the political contribution credit, in case you are so inclined?

Final two words: Charitable Donations

Tax credits step-up for charitable donations, so it has become common practice for spouses to pool their donations and claim them on one person’s return. You could alternate years to be fair. This isn’t actually in the Income Tax Act, but to date, the practice hasn’t been tested by CRA. The good thing is that there’s a long list of tax credits you may be able to take advantage of. Your tax accountant at brampton can walk you through them. Please ensure your accountant at brampton is competent in Canadian Taxes and can defend you in case of audit by CRA. There are also other ways you can save tax dollars by your accountant at Brampton, for more information please call 905-794-8283.

For more information:

http://ca.finance.yahoo.com/news/When-couples-hover-tax-goldengirlwp-2699196896.html?x=0

Accountant Plays A Key Role In The Growth and Success Of A Business

In today’s world it is very crucial to hire qualified and experienced accountant at Brampton in order for your business to be successful. Accounting is usually defined as the art of recording, classifying, and summarizing transactions of a financial manner, and interpreting the results in order to ascertain the financial status of a certain business entity. Financial statements are produced and reported by an accountant at brampton for the perusal and use of different individuals.

Internal clients are the managers and stockholders of a company who need an accountant’s reports in order to make sound management or operating decisions. Of course, a company’s financial stability should be considered when planning to invest in other projects or decide on an expansion, Corporate tax at Brampton. This type of accounting is aptly termed Management Accounting at Brampton, because it provides relevant information to people inside the business such as the ones mentioned above.

Financial accounting is the type of accounting needed to provide information to people outside the business, or the external clients. It presents financial data that may be useful to external clients such as creditors (like banks), financial analysts, economists, and government agencies by Accountant Brampton.

In Brampton, a city in Canada, an accountant is entrusted with a great deal of responsibility. The accountant is in charge of keeping track of a company’s money. The reports that he produce are indeed relevant to different users. The government, for example, need an accurate and honest financial report in order to determine how much tax the company must pay.

Large companies and those who have only just started a business based in Brampton rely on the skill of an accountant to make accurate financial statements that help people decide whether they want to invest in the company or not. Potential investors, customers, and future stockholders will have to determine if the company they are eyeing is worth investing their money in. Thus, the Brampton accountant plays a key role in the growth and success of a business, as his work has many important uses to internal and external clients as well.

For more information:

Why accountants at Brampton are essential for a business

The accountants at Brampton are competent in corporate tax, corporate accounting, etc. and as well have many years of practical Canadian experience. When you hire accountant at Brampton, you are not only getting great service at reasonable price but also supporting the local economy. Many small businesses make the mistake of assuming that they really do not require the continuous services of accountants at Brampton. The success of a business depends on the groundwork. It is the foundation laid that will determine the progress of the business and it is essential that the services of accountants at brampton are taken into consideration at the very outset. Being from within the local community, these accountants at brampton will have local contacts that will help

your business network with other local ventures. Accountants at Brampton with experience will have up to date knowledge of which expenses are deductable and have a genuine knowledge of updated regulations and of any law changes and be ready to apply such to your business accordingly.

Professional accountants at Brampton are geared to predict any potential downsides and would be able to advice a start up business on precautionary measures that could be taken. Plus these accountants at brampton would be able assess a business proposition objectively and weigh the pros and cons on behalf the business. It is always smart to seek the advice of brampton accounting firm before making any business moves. This could end up saving your business a lot in the long run. Further, experienced accountants at Brampton will always be up to date on the latest software required for proper maintenance of company accounts and ensure it is maintained professionally.

By selecting a local accounting firm in Brampton, it is easy to build a proper working relationship. The knowledge the firm would have about the area and being easily reachable for face to face meetings definitely helps the working relationship. Indeed, that is what any business should have with its accountants at brampton- a relationship which grows as the business grows. Making your accountants at Brampton part of the journey ensures they are always on the lookout for the best for the business.

For more information: